Marine insurance case study

Generally speaking, marine policies will cover goods during the various stages of transit from the seller’s door to the buyer’s door. There are many different types of marine polices, so it is important to understand the limitations and risks covered in your policy.

INCO Terms, the standard delivery terms established by the International Chamber of Commerce, provide for insurance to be included in agreements between the seller and buyer; CIF for example (Cost of goods + Insurance + Freight) which provides the buyer with insurance cover to either a destination port or depot.

In a recent case handled by ITM the buyers agreed term was CIF Sydney port with the insurance liability moving to the buyer once the goods moved from the vessel to the wharf. However, the container fell from the overhead crane back onto the vessel. In this case the shipper was able to claim on their marine policy as the container had not yet reached the destination port. However if the accident had occurred whilst the container was on the terminal the shippers policy may not have provided cover for any loss or damage and, had the buyer not taken out their own cargo insurance policy, they may have faced a situation where they were liable for the loss.

Under international laws and conventions*, carriers such as shipping lines and airlines are generally NOT held liable for damages to cargo due to a multiplicity of possible causes including:

(a) act, neglect, or default of the master, mariner, pilot or the servants of the carrier in the navigation or in the management of the ship;

(b) fire, unless caused by the actual fault or privity of the carrier;

(c) perils, dangers and accidents of the sea or other navigable waters;

(d) act of God;

(e) act of war;

(f) act of public enemies;

(g) arrest or restraint of princes, rulers or people, or seizure under legal process;

(h) quarantine restrictions;

(i) act or omission of the shipper or owner of the goods, his agent or representative;

(j) strikes or lock-outs or stoppage or restraint of labour from whatever cause, whether partial or general;

(k) riots and civil commotions;

(l) saving or attempting to save life or property at sea;

(m) wastage in bulk or weight or any other loss or damage arising from inherent defect, quality or vice of the goods;

(n) insufficiency of packing;

and others.

In some specified limited circumstances, carriers may be held liable but the amount of liability is limited to the cost of the freight or up to, currently, around $34 per kg for airfreight and just $4 per kg for sea freight (based on a specified number of Special Drawing Rights under the International Monetary Fund).

Therefore it is extremely important that shippers and importers alike have in place appropriate cargo insurance to protect their business from financial harm arising from damage to or loss of cargo while in transit.

Accidents can and do happen. Which brings us back to our initial question - Are you adequately covered?

Carrier’s and freight forwarders alike, do not generally have an insurable interest in the cargo they move on behalf of their clients. Therefore cargo cover is not ‘automatic’ and cargo owners need to specifically choose the cover they require or accept the risk of not being insured. If you have any questions about your marine or cargo insurance policy please contact your ITM Supply Chain Specialist for advice.

If you have any questions about your marine or cargo insurance policy please contact your ITM Supply Chain Specialist for advice.

* Limited liability under the terms and conditions of carrier’s bills of lading and air waybills is generally a reflection of, and supported by, international laws and conventions such as the Hague-Visby Rules and the Montreal Convention 1999.

John Vaccaro

Sydney Branch Manager

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

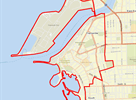

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert