Cost impact of IMO 2020

As everyone may have read, as of January 2020, all ships are required to use fuel with a sulphur content of 0.5% or less on all of the world’s oceans.

It is estimated that 3.9 million barrels a day are used on ships traversing the oceans.

The ship owners have a few options to ensure compliance and meet lower sulphur emission standards, each with some pros and cons.

|

Option |

Pros |

Cons |

|

Low Sulphur Fuel |

Most environmentally friendly solution |

High cost, low availability |

|

LNG |

Negligible sulphur oxide emissions |

High infrastructure costs; too expensive to convert older ships |

|

Scrubbers |

Cleans emissions before they are released into the atmosphere |

Substantial investment required; ships must dry dock to be retrofitted; lines need to comply with wash water disposal regulations in various countries |

But various lines have been using various methods as listed above and only time will tell which of the options are popular.

Naturally, such compliance requirements bring along with it additional costs and uncertainty in terms of fuel costs for shipping lines and customers.

Carriers will be exposed to huge costs in preparing the ships to meet the required standards, some of which costs are expected to be incurred as part of the preparations for IMO2020.

MSC estimates that the cost of the various changes that will need to be made to their fleet and its fuel supply is in excess of two billion dollars (USD) per year while Maersk Line expects its extra fuel and compliance costs to exceed USD 2 billion.

Hapag Lloyd’s CEO mentioned that they are expecting their low sulphur fuel costs to be around USD75-100 million during the 4th Quarter of 2019 in order to be ready for IMO2020 implementation date of Jan 1, 2020.

Many shipping lines like CMA-CGM, ONE, OOCL and APL had announced that the costs for compliance will have to be passed on to customers/trade and this will be done through the implementation of new or adjustment to existing fuel surcharges, which may vary based on the trade lanes.

What will be the impact of IMO2020 on cargo owners??

Well, the shipping lines have made their intentions clear by implementing additional surcharges to cover for these extra costs that they will be incurring to operate their ships on cleaner fuel.

They have categorically announced that they are not going to pay for these costs alone as environmental protection is everyone’s baby.

So naturally either the seller or buyer will have to foot the bill for these additional surcharges.

On one hand, while the cost impact of IMO2020 could be a deal-breaker for many, it could be an opportunity for many others to develop biofuels for use in the ships.

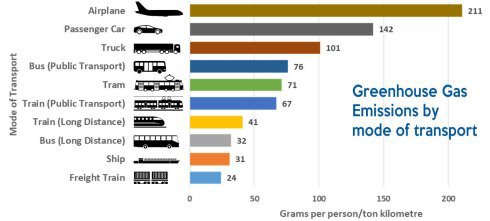

We may not yet be able to calculate the true cost of IMO2020 for consumers around the world but what we do know that this has been implemented to combat climate change in whichever way possible although maritime shipping has one of the lowest carbon emissions compared to other modes of transport.

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert