Analysts predict that the impact of IMO 2020 will mean slower ships and more transhipment.

This would be a further blow to shippers who also face additional costs to compensate carriers for using cleaner fuel from 1 January, 2020.

Shippers may dislike surcharges, but they universally hate transhipment, as it introduces another level of risk to the supply chain.

Ocean carriers face a challenging period when they need to obtain acceptance from their customers to adopt their fuel surcharge mechanisms in preparation for the introduction of the IMO’s 2020 0.5% sulphur cap on the maritime sector.

Drewry warns that if there is a failure to pass on a higher than historical average 50% success rate for fuel increases, then the substantial extra cost of low-sulphur fuel “could be ruinous for some lines, many of which are still operating with highly distressed balance sheets”.

If they fail to recover full costs, Drewry said, “carriers will inevitably seek to mitigate the anticipated higher operating expenses” by introducing further measures to conserve the more-expensive fuel. “One potential side-effect from the new regulations could be greater slow-steaming and use of transhipment,” said Drewry.

“The logic being that, as ships’ sailing speed is reduced and round voyages are extended, carriers will drop ports from rotations to ensure that transit times to key points remain competitive,” said the consultant. It noted: “Fewer direct port calls will induce greater need for transhipment and feeder operations.”

Shippers are not fans of transhipment, which can add significant delay to the arrival of goods and, in some circumstances; containers can be discharged at destination at a different terminal.

Shippers want “real time transparency on their cargo whereabouts”, which could be clouded by transhipment. Moreover, transhipment disguises the real level of delay to the already poor reliability statistics of ocean carriers, given that the measure for a vessel’s schedule integrity is from port to port without the insight of transhipment delays to the cargo.

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

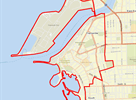

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert